The first smart helmet embedding an insurance for every micromobility.

Offer launching in June 2024. Sign up to receive all the launch details. The first 50 purchases will receive a free Securain Cosmo Connected bag.

A unique combination for greater simplicity and protection,

regardless of you daily journeys.

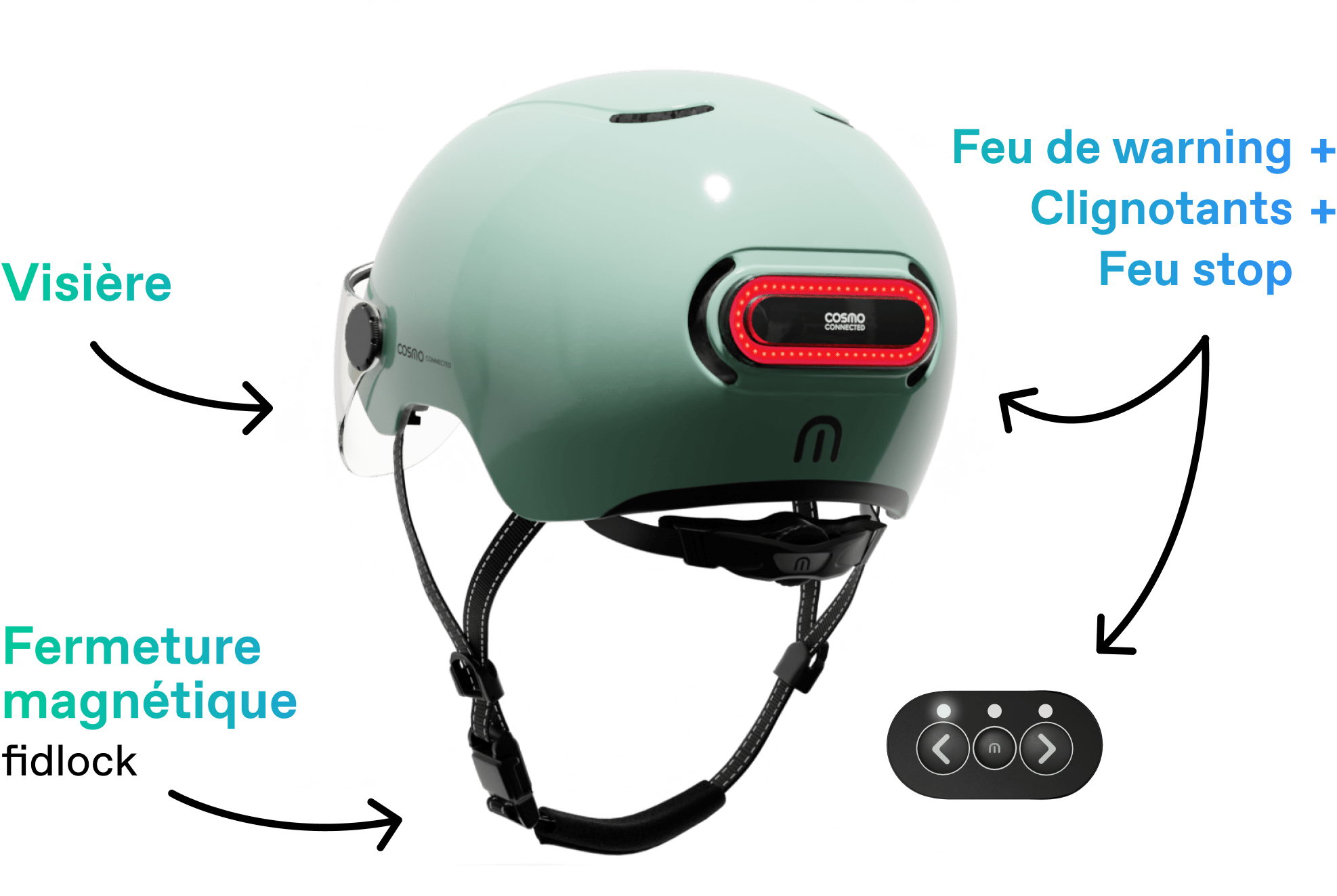

SMART HELMET

COSMO FUSION

INDIVIDUAL ACCIDENT

COVERAGE

In the event of a serious bodily injury, whether or not the liability of a third party is involved, the financial consequences for the individual can be extremely high.

Individual Insurance Coverage aims to protect against this real and serious risk and can cover medical expenses, hospitalization, rehabilitation, loss of income, or death.

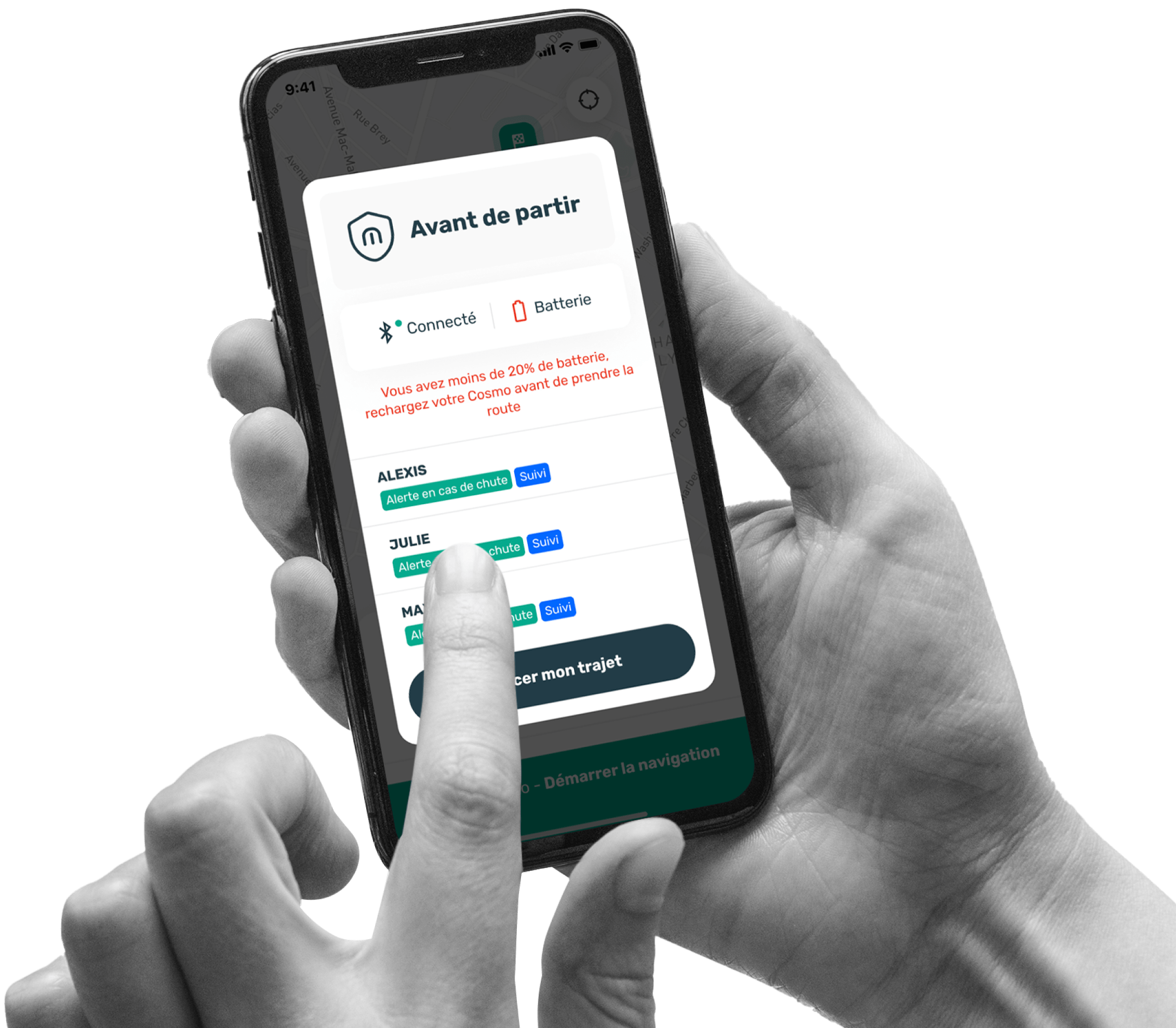

Turn on your smart helmet, launch the app.

You are covered throughout your journey.

If you switch micromobility, you are still covered.

And that's a first.

The unique integration of insurance into our Cosmo Fusion+ helmet addresses a growing need for simplicity and safety in the context of multimodal mobility. Traditional insurance solutions, such as home insurance, credit card coverage, or those specifically linked to vehicles, often fail to adequately cover the new uses and risks associated with the diverse and varied use of personal motorized transportation modes.

Our offer combines physical protection and soon liability insurance to adapt to all types of journeys, ensuring comprehensive coverage regardless of the means of transportation used.

Getting well-equipped has never been more affordable.

For only €9,99/month , drive peacefully on your journeys.

An offer that brings together the very best expertise.

Any question?

We'll answer it for you.

Users can subscribe directly online on our website by purchasing the Cosmo Fusion+ product, the first product of the Cosmo Care offer.

Currently, the insurance is valid only in France, allowing worry-free use during travels in this territory.

The insurance coverage is active for 24 months from the date of purchase, providing extended peace of mind for users.

Individual Accident Guarantee (IAG) covers you for any physical injuries sustained in an accident. Therefore, it covers part of the resulting expenses, regardless of fault. This means you can receive compensation even if you injure yourself accidentally. Consequently, you're compensated whether you're at fault or not, and regardless of whether a third party is identified as responsible, no matter your vehicle.

At the moment, Cosmo Care is offered in a single standard plan that suits the majority of micromobility users, which includes our connected helmet plus personal accident insurance for the rider. However, an offer including new mobility civil liability will be available in the coming months.

No, the Cosmo Care offer with financing partner Floa is a 24-month loan. The APR is 0% and financed by Cosmo Connected.

Multi-Risks Home insurance or credit cards rarely cover serious bicycle or e-scooter accidents. An Individual Accident Guarantee through Cosmo Care offers a comprehensive protection in case of severe injuries, covering medical expenses, financial repercussions, and rehabilitation needs. For optimal safety and peace of mind, this insurance is essential for micromobility users.

*A loan is a commitment and must be repaid. Check your repayment capacities before committing.

Example for a purchase of €239.80*. Repayment in 24 monthly installments of €9.99**. Fixed APR of 0.00% and fixed borrowing rate of 0.00%. Total amount due (excluding optional insurance): €239.80. Monthly cost of optional insurance: €0.41*** in addition to the installment. The annual effective insurance rate is 0.17%. Total amount due for insurance: €9.84.

***Equivalent to 0.17% of the borrowed capital per month for a borrower under 66 years old for Death, Total and Irreversible Loss of Autonomy (PTIA), and Total Temporary Disability (ITT) coverage. Contract underwritten by FLOA with ACM VIE SA (Public limited company with capital of €778,371,392 – STRASBOURG RCS 332 377 597 – Headquarters: 4 Frédéric-Guillaume Raiffeisen Street - 67000 STRASBOURG Postal address: 63 Chemin Antoine Pardon, 69814 TASSIN cedex) and SERENIS ASSURANCES SA (Public limited company with capital of €16,422,000 – ROMANS RCS 350 838 686 – Headquarters: 25 Doctor Henri Abel Street, 26000 VALENCE - Postal address: 63 Chemin Antoine Pardon, 69814 TASSIN cedex), companies governed by the Insurance Code.